Leland Library

Expert-written articles, free resources, detailed guides, and more to help you accomplish your goals.

March 6, 2026

Types of MBA Programs (Exec, Part-Time, Online, 1-Year) & Which One is Right for You

Executive MBA, part-time, online, or 1-year? Compare all MBA formats, recruiting access, and ROI to choose the right path for your career goals.

February 12, 2026

What It (Actually) Takes to Land a Job: Number of Applications, Cost, & Career Center Support

New data from thousands of students reveals the hidden costs of getting hired: 135 hours, 78 applications, and hundreds to thousands of dollars spent, with major disparities by field, race, and school. Plus, the helpfulness of career centers and what students are doing to increase their chances.

February 5, 2026

How to Get Into the Meta RPM Program (2026)

Learn how to get into the Meta RPM Program in 2026 with our step-by-step guide. Discover eligibility, tips, and key insights to boost your application success.

January 27, 2026

Finance Internships for College & High School Students (2026)

Calling all finance freshmen. Get practical tips to prepare for a finance internship and insights into top finance roles now accepting applications.

January 27, 2026

The Top 10 Investment Banks – By Size & Tier (2026)

Discover the top investment banks by size and tier in 2025. Get insights into the biggest players in finance and what sets them apart in this detailed guide.

January 13, 2026

What is an MBA Degree? An Expert Guide (2026)

The ultimate guide to MBA degrees, this article covers what an MBA is, the different types of programs, cost breakdown and financing options, curriculum and specializations overview, benefits and key factors to consider, and much more.

January 12, 2026

How Long Does it Take to Hear Back From a Job?

Wondering how long it takes to hear back from a job? Learn average response times, why hiring managers delay, and how to send a professional follow-up email.

Recent articles

March 6, 2026

Top 10 Law Schools for International Law in 2026 (Rankings & Programs)

Compare the top 10 best law schools for international law in 2026. See rankings, acceptance rates, LSAT medians, and global career paths.

March 6, 2026

Top 25 1-Year MBA Programs in 2026 (Online & USA Rankings)

Discover the top 25 1-year MBA programs for 2024 and make an informed decision for your future career.

March 6, 2026

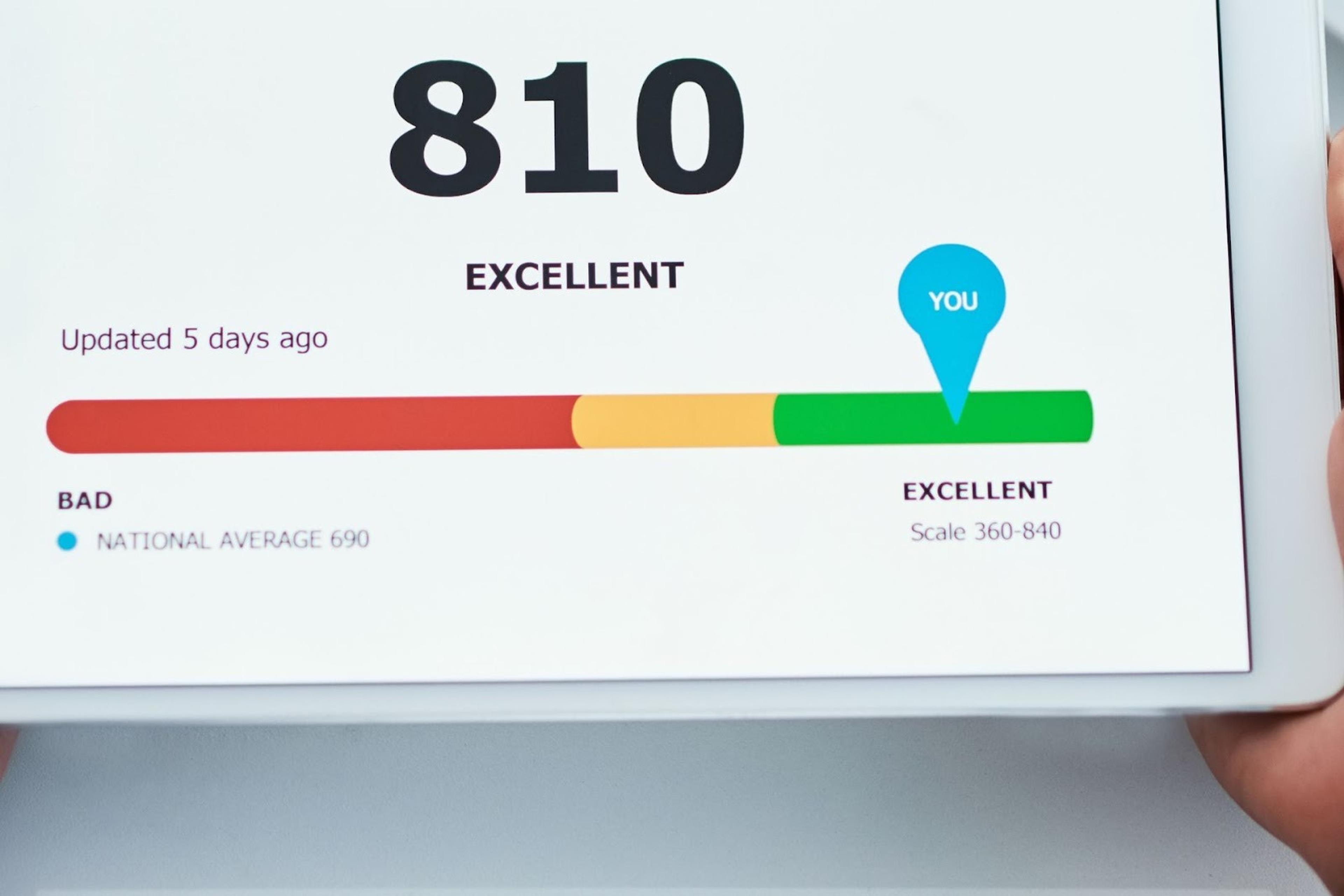

GMAT Score for Harvard MBA: Quant/Verbal Median & Ranges

GMAT score for Harvard explained: median scores, quant/verbal ranges, and what you really need to be competitive at HBS.

March 6, 2026

What Is the GMAT Whiteboard? Rules, Dimensions, & Requirements

Learn how to use the GMAT whiteboard effectively on test day—rules, dimensions, tools, and expert tips for both the online and physical formats.

March 6, 2026

What is a Perfect GMAT? Highest Possible Score (2026)

Learn how to achieve the highest GMAT score with expert strategies, updated 2026 scoring insights, and real tips from 800-level test takers.

March 6, 2026

Consulting Recruiting Timeline 2026: Key Dates & Application Deadlines

Plan your path to MBB and beyond with this complete consulting recruiting timeline—deadlines, strategies, and expert prep tips.

March 6, 2026

GMAT Verbal Breakdown: Question Types, Practice, & How to Increase Your Score

Master GMAT verbal with expert strategies for reading comprehension and critical reasoning. Learn question types, scoring, and proven ways to raise your score.

March 6, 2026

Top Consulting Firms in Atlanta in 2026 (Management & IT Rankings)

Compare the top consulting firms in Atlanta. See expert rankings, specialties, and how to choose the right firm for your business.

March 6, 2026

Types of MBA Programs (Exec, Part-Time, Online, 1-Year) & Which One is Right for You

Executive MBA, part-time, online, or 1-year? Compare all MBA formats, recruiting access, and ROI to choose the right path for your career goals.

March 5, 2026

1, 3, and 6-Month GMAT Study Plans (Expert-Approved)

Learn how to create a GMAT study plan that fits your goals, timeline, and score target, with expert strategies, tools, and test-day tips.