Marginal Profit: What it Is & How to Calculate It

The ultimate guide to marginal profit, including what it is and how to calculate it with realistic examples and explanations that break down each of its components.

Posted March 6, 2025

Table of Contents

It's best to identify every possible avenue for improving profit margins, especially in today's highly competitive business environment. One of the best ways to achieve this is by focusing on marginal profit – the additional profit generated by selling one more unit. While the change may seem small, understanding how to calculate marginal profit and marginal revenue can have a big impact on the bottom line.

This guide will walk you through the steps to find and leverage opportunities to maximize profits through marginal profit analysis.

What is Marginal Profit?

Marginal profit is the additional profit a business earns from producing and selling one more unit of a good or service. It is calculated by subtracting the marginal cost (the cost of producing one additional unit) from the marginal revenue (the revenue earned from selling that unit).

Why is Marginal Profit Important?

With a focus on calculating marginal profit, businesses can increase their overall profitability without significantly raising sales volumes, a tactic especially useful in high-competition industries with low margins. Marginal profit formula calculations are an essential tool for understanding how each additional unit contributes to profitability.

A significant part of maximizing marginal profit is minimizing marginal cost. Reducing fixed costs and negotiating better prices with suppliers, improving production processes, or investing in more efficient equipment can lower the marginal costs associated with each unit.

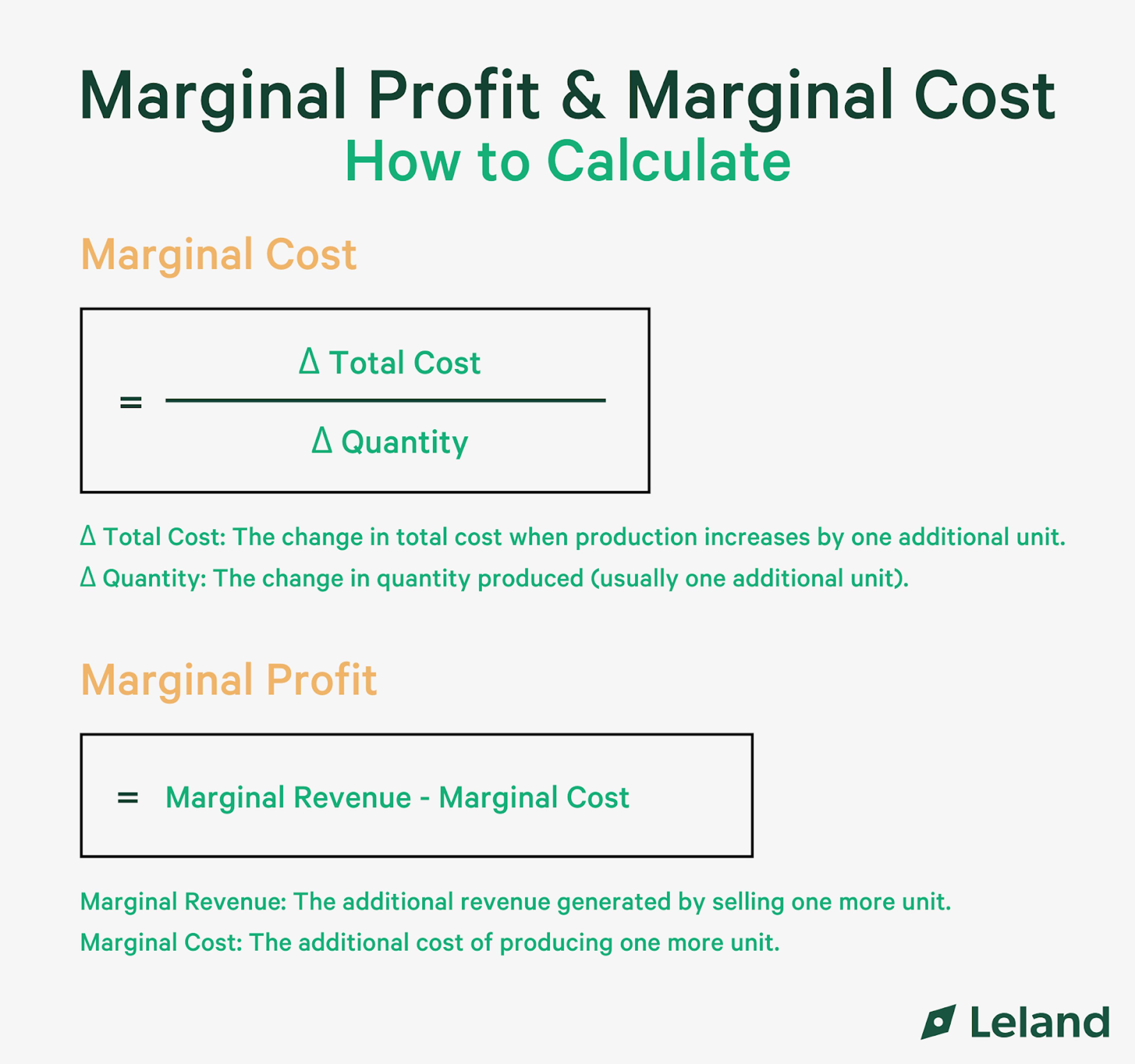

How to Calculate Marginal Profit & Marginal Costs

Marginal Cost Formula & Calculation

Marginal Cost = Δ Total Cost / Δ Quantity

The marginal cost equals the change in total cost divided by the change in quantity produced.

- Δ Total Cost: The change in total cost when production increases by one additional unit.

- Δ Quantity: The change in quantity produced (usually one additional unit).

How to Calculate Marginal Cost

- Identify the total cost of producing the current quantity of goods (e.g., 100 units cost $1,000).

- Determine the total cost after increasing production by one more unit (e.g., 101 units cost $1,030).

- Subtract the initial total cost from the new total cost: $1,030 - $1,000 = $30.

- Divide the change in total cost by the change in quantity: $30 / 1 = $30.

- This means the marginal cost of producing one additional unit is $30.

Marginal Profit Formula & Calculation

Marginal Profit = Marginal Revenue - Marginal Cost

- Marginal Revenue MR: The additional revenue generated by selling one more unit.

- Marginal Cost: The additional cost of producing one more unit (calculated above).

How to Calculate Marginal Profit

- Determine the price at which you sell one additional unit (e.g., $50 per unit).

- Use the marginal cost calculation to find the cost of producing that unit (e.g., $30).

- Subtract the marginal cost from the marginal revenue: $50 - $30 = $20.

- This means the marginal profit for selling one additional unit is $20.

Examples

Example 1: Simple Example

Scenario: A lemonade stand currently produces 10 cups of lemonade at a total cost of $10. Each cup is sold for $2. Producing one more cup increases the total cost to $11.

- Step 1: Marginal Cost = ($11 - $10) / (11 - 10) = $1

- Step 2: Calculate Marginal Profit

- Selling the 11th cup earns $2 in revenue

- Marginal Profit = $2 - $1 = $1

Conclusion: Producing and selling one more cup of lemonade generates an additional profit of $1.

Example 2: Intermediate Example

Scenario: A bakery produces 100 cakes at a total cost of $500. Each cake is sold for $8. Producing one more cake increases the total cost to $505.

- Step 1: Marginal Cost = ($505 - $500) / (101 - 100) = $5

- Step 2: Calculate Marginal Profit

- Selling the 101st cake earns $8 in revenue

- Marginal Profit = $8 - $5 = $3

Conclusion: Producing and selling one additional cake generates an extra profit of $3.

Example 3: Advanced Example with Variable Marginal Revenue

Scenario: A clothing manufacturer produces 500 shirts at a total cost of $10,000. Shirts are sold at $25 each, but to sell the 501st shirt, the company offers a discount, lowering the price to $24 per shirt. Producing the 501st shirt increases the total cost to $10,025.

- Step 1: Marginal Cost = ($10,025 - $10,000) / (501 - 500) = $25

- Step 2: Calculate Marginal Revenue – the 501st shirt is sold for $24.

- Step 3: Marginal Profit = $24 - $25 = -$1.

Conclusion: Producing and selling the 501st shirt results in a negative marginal profit of $1. In this case, it may not be profitable to produce the extra unit unless costs can be reduced or the price can be maintained.

The Difference Between Marginal Profit and Gross Profit

Marginal profit and gross profit are distinct concepts that play different roles in understanding a company’s profitability. Marginal profit refers to the additional profit earned from producing and selling one more unit of a good or service. It focuses on incremental changes in revenue and cost, helping businesses optimize production levels and make data-driven pricing decisions.

Gross profit, on the other hand, represents the total revenue a company earns after subtracting the cost of goods sold (COGS). It is calculated over all units sold, providing a broader picture of overall profitability without delving into per-unit changes.

The key difference lies in scope: gross profit evaluates overall profitability, while marginal profit hones in on the financial impact of individual units. While gross profit is useful for assessing the health of a business, marginal profit offers deeper insights into cost management and pricing strategies, helping businesses maximize profits at the most granular level.

The Benefits of Focusing on Marginal Profit

Focusing on marginal profit provides businesses with a clearer, more nuanced understanding of profitability at the unit level, allowing for more strategic decision-making. Unlike gross or average profit, which offers only a broad view of profitability, marginal profits dig deeper, helping businesses uncover hidden opportunities to increase revenue and reduce costs.

Here are some specific benefits of focusing on marginal profit:

- It can boost net profit without the need to significantly increase sales volume.

- It can identify cost-saving opportunities in production and distribution, helping maintain competitiveness in low-margin markets.

- It can provide insights into optimal production levels by understanding when marginal profit equals zero.

- It helps leaders make more informed pricing decisions and enables companies to set a selling price that accurately reflects production costs and remains competitive.

- It enhances profit maximization by offering a precise view of marginal unit profitability beyond average profit.

How to Identify Opportunities for Improvement

1. Analyze your current margins

Begin by reviewing your current margins for each product or service. Break down fixed costs, marginal costs, and revenue to accurately calculate marginal profit on each additional unit sold. This will help you see how each item contributes to profitability. If certain products are low or if the marginal profit turns negative, consider adjusting production levels or reevaluating pricing.

2. Use analytics and accounting software

Use analytics and accounting tools to streamline marginal profit calculation. These tools can provide deeper insights into costs and average profit per product, giving you a clearer understanding of where to optimize. QuickBooks, FreshBooks, or Excel are common tools to use; you can also set up an analytics dashboard to track how production scale impacts cost per unit and identify thresholds where your costs rise significantly.

3. Study your competitors

Research similar products offered by competitors. By analyzing competitor pricing, you can identify opportunities to adjust your selling price and improve your margins. This research can also reveal where your product differentiation could help you achieve marginal revenue goals. For instance, if a competitor charges $5 more but offers free shipping, consider whether adding a similar feature would allow you to increase your prices while staying competitive.

4. Find ways to differentiate

Pinpoint areas where your products or services stand out from the competition. Leveraging these unique aspects can help you better position your offerings, potentially boosting marginal profit by attracting customers who see added value.

5. Run pricing experiments

Test different pricing strategies for your products to see how they affect demand and marginal profit. For instance, raise the price of one product by 5% for a limited time and monitor whether the increase in revenue outweighs any potential drop in sales volume. Small experiments like this can reveal opportunities to improve your overall profit margins.

Use Case Examples

McDonald's

McDonald's has improved its marginal profit by negotiating bulk discounts with suppliers and sourcing ingredients locally in many regions, which reduces transportation costs. They’ve also optimized portion sizes and streamlined kitchen operations, cutting down on food waste without compromising customer satisfaction. These steps have helped McDonald's increase profit margins across its global locations.

Mayo Clinic

Mayo Clinic increased its marginal profit by optimizing its scheduling system to reduce patient wait times and serve more patients each day. Additionally, they introduced telehealth options, allowing them to provide value-added services without needing extra physical resources. This not only boosted patient satisfaction but also generated new revenue streams, contributing to a higher marginal profit per appointment.

Starbucks

Starbucks implemented its successful loyalty program, Starbucks Rewards, to encourage repeat purchases by offering rewards and exclusive offers to frequent customers. This program helped increase marginal profit by enhancing customer retention and reducing the cost of acquiring new customers. It also boosted average spending per visit, further improving Starbucks’ profitability.

How to Integrate Marginal/Pricing Strategies

Set clear, actionable goals

Define specific and measurable targets for improving marginal revenue and profit. For example, aim to increase marginal profit by 10% over the next quarter by optimizing pricing or reducing production costs. Break these goals down by product line or customer segment to focus your efforts where they’ll have the most impact.

Identify and prioritize quick wins

Look for small changes that can deliver immediate results. This may look like:

- Renegotiating supplier contracts to reduce material costs by 5%.

- Bundling high-margin products with popular low-margin items to increase overall profitability.

- Offering dynamic pricing during peak demand to capture additional revenue without adding costs.

Leverage data for decision-making

Use tools like Tableau, Power BI, or Excel to track key metrics such as marginal cost, marginal revenue, and profit per unit in real-time. For example, monitor which products consistently yield high marginal profits and allocate more resources to promote or produce those items.

Pilot new strategies

Before making major changes, test them on a small scale. For example:

- Trial a new cost structure in one region or with a specific customer group to evaluate its impact on sales and profitability.

- Experiment with cost-saving production methods for a single product line to measure their effect before scaling.

Optimize underperforming products

Review products with low or negative marginal profits. Tactics could include:

- Streamlining production processes to lower costs.

- Phasing out items that consistently lose money and redirecting resources to profitable ones.

- Repackaging or repositioning products to better meet market demand and command higher prices.

Build stakeholder alignment

Share your goals and strategies with relevant teams (e.g., production, sales, and marketing). For example, host workshops to explain how pricing changes or cost reductions impact overall profitability. Ensure teams understand their role in achieving marginal revenue improvements.

Monitor and iterate regularly

Set up weekly or monthly reviews to track progress toward your goals. For instance:

- Use dashboards to visualize changes in marginal profit across product lines.

- Identify deviations from targets and discuss adjustments with your team during regular meetings.

Implement continuous feedback loops

Regularly solicit input from employees, customers, and suppliers to uncover new opportunities. For example, ask your sales team about customer objections to pricing changes or consult suppliers about alternative materials to reduce costs. Use this feedback to refine strategies.

Measuring Success: Key Metrics to Track When Focusing on Marginal Profit

Tracking key metrics is essential to determining the success of any marginal profit strategy. Because profit is affected by so many factors and affects so many factors, having a good handle on related metrics will ensure that changing one thing doesn’t result in hurting something else.

| Metric | What it Does |

| Margin per unit | The profit earned on each unit sold after deducting costs. This metric is essential for understanding product-level profitability. |

| Operating expense ratio | The percentage of revenue used to cover operating expenses. A lower ratio indicates better operational efficiency. |

| Cost of goods sold (COGS) | The direct costs of producing goods or services. Tracking COGS helps identify areas to reduce expenses and improve margins. |

| Revenue growth rate | The percentage increase in revenue over a specific period. This metric helps evaluate whether your strategies are driving top-line growth. |

| Contribution margin | The difference between sales revenue and variable costs per unit. It shows how much revenue is available to cover fixed costs and generate profit. |

| Break-even point | The production or sales level where total revenue equals total costs. This helps determine the viability of marginal profit strategies. |

| Customer acquisition cost (CAC) | The cost of acquiring a new customer. Lowering CAC while increasing marginal profit enhances overall profitability. |

| Customer lifetime value (CLV) | The total revenue expected from a customer over their relationship with your business. Pairing CLV with marginal profit highlights the long-term impact of pricing and cost strategies. |

| Net profit margin | The percentage of revenue that remains as profit after all expenses. It complements marginal profit by showing overall financial efficiency. |

| Return on investment (ROI) | Measures the profitability of specific investments, such as production or marketing. This helps assess the impact of cost changes on overall profit. |

| Inventory turnover ratio | Tracks how frequently inventory is sold and replaced. High turnover with positive margins reflects effective cost and pricing strategies. |

| Variable cost ratio | The percentage of revenue spent on variable costs. A lower ratio indicates higher efficiency in generating profit. |

| Price elasticity of demand | Measures how sensitive customer demand is to price changes. Understanding elasticity helps refine pricing strategies to maximize marginal profit. |

| Gross margin return on investment (GMROI) | Evaluates profitability relative to inventory investment. It indicates how efficiently inventory contributes to overall profit. |

Common Pitfalls to Avoid When Optimizing Marginal Profit

Optimizing marginal profit is a powerful strategy, but it requires careful planning and execution to avoid common missteps. Here are the pitfalls to watch for and how to navigate them effectively:

1. Overestimating the impact of small changes

Expecting significant profit gains from minor adjustments, such as slightly reducing production costs or marginally increasing prices, can lead to unrealistic expectations. Instead, combine incremental improvements across multiple areas – such as production, pricing, and marketing – to achieve meaningful results over time.

2. Failing to address stakeholder alignment

Poor communication with key stakeholders, like employees, suppliers, or customers, can create resistance to changes. For example, adjusting pricing or reducing costs may raise concerns about quality or value. Proactively share data and explain how these changes benefit the business and align with shared goals to secure buy-in.

3. Focusing solely on short-term wins

Prioritizing immediate gains, such as cutting costs at the expense of product quality or customer satisfaction, can damage your brand and erode long-term profitability. Ensure that every change supports sustainable growth. For instance, reducing costs by sourcing cheaper raw materials might save money today but could lead to customer churn if quality declines.

4. Ignoring negative marginal profit scenarios

Continuing to produce or sell items with negative marginal profit – where costs exceed revenue – can quietly drain resources and undermine overall profitability. Regularly review margins at the product or service level to identify and address underperforming areas. If a product has negative marginal profit, explore cost reduction strategies, price adjustments, or even discontinuing the item.

5. Underestimating market dynamics

Failing to account for external factors, such as competitive pricing, supply chain disruptions, or shifts in customer demand, can render your marginal profit strategies ineffective. Regularly update your calculations and revisit assumptions to reflect current market conditions.

6. Lack of ongoing measurement and iteration

Marginal profit isn’t static – it fluctuates with changes in production, pricing, and external factors. Businesses that fail to track key metrics and adjust strategies based on real-time data risk making outdated or counterproductive decisions.

How to Avoid These Pitfalls

Start by conducting thorough analyses before implementing any changes to ensure their potential impact is well understood. Align stakeholders early in the process by providing clear data and illustrating how proposed strategies will benefit both the organization and its team members. Take a balanced approach by combining short-term actions, such as cost reductions or pricing adjustments, with long-term improvements that sustain profitability and customer satisfaction. Regularly review and update marginal profit calculations to identify and correct negative trends before they impact overall performance. Additionally, use pilot tests or small-scale experiments to validate the effectiveness of changes and gather actionable insights before rolling them out on a larger scale. This approach ensures that your strategies remain flexible, data-driven, and aligned with both immediate and long-term business goals.

The Bottom Line

While focusing on marginal profit requires investment, the benefits of understanding and improving marginal revenue, reducing marginal cost, and maximizing profitability are substantial. By pursuing marginal profit as a key metric, you can build resilience and profitability that supports growth and sustainability, even in competitive markets.

To fully maximize a business's profit potential, connect with one of Leland’s coaches for personalized, expert guidance that will help achieve lasting growth and success.

FAQs

How do you find the marginal profit?

- Marginal profit is the increase in profits resulting from the production of one additional unit. Marginal profit is calculated by taking the difference between marginal revenue and marginal cost.

How do you calculate profit margin step by step?

- Determine your business's net income (Revenue – Expenses) Divide your net income by your revenue (also called net sales) Multiply your total profit by 100 to get your profit margin percentage.

How do you calculate marginal profit and revenue?

- To calculate the marginal revenue, a company divides the change in its total revenue by the change in its total output quantity. Marginal revenue is equal to the selling price of a single additional item that was sold.

What is the marginal approach to profit determination?

- Under the mainstream economic theory, the marginal approach to profit maximization states that if a company chooses to maximize its profits, it should continue producing a good or service up to the point where the marginal revenue is equal to the marginal cost (marginal profit is zero).

What is the marginal profit theory?

- Under the mainstream economic theory, the marginal approach to profit maximization states that if a company chooses to maximize its profits, it should continue producing a good or service up to the point where the marginal revenue is equal to the marginal cost (marginal profit is zero).