Private Equity Career Overview: Jobs, Path, & Salary

Explore private equity jobs with clear insights on roles, career paths, and salaries. Learn what to expect and how to succeed in the field.

Posted August 26, 2025

Join a free event

Learn from top coaches and industry experts in live, interactive sessions you can join for free.

Table of Contents

What Are Private Equity Jobs?

Private equity (PE) involves investing in privately held companies to enhance their value and eventually sell them for a profit. PE firms inject capital, refine operations, and implement strategic changes to foster growth. The typical exit strategy is selling the company to a larger firm and then taking it public through an Initial Public Offering (IPO), or finding another investor to buy it.

What sets PE apart from hedge funds and venture capital is its focus on control investments. PE firms often acquire entire companies or significant stakes, while hedge funds trade liquid assets, and venture capital backs early-stage businesses.

Day-to-Day Activities in Private Equity

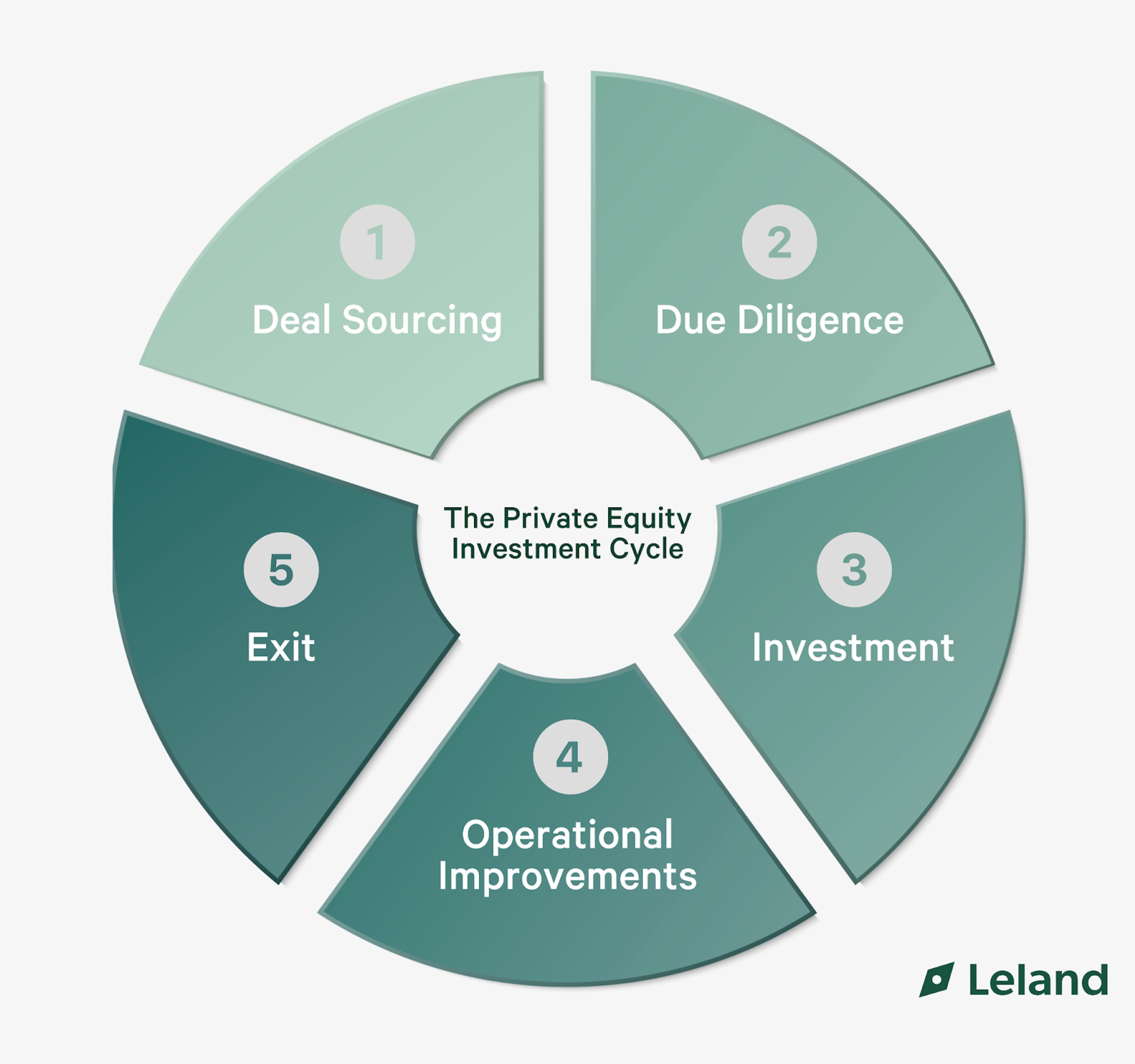

In private equity, the investment cycle involves several key stages that help maximize returns. It starts with deal sourcing, where you identify potential investment opportunities by researching industries, networking, and scouting for companies that fit the firm’s strategy. Once a target is identified, due diligence follows, where you deeply analyze the company’s financials, operations, and market position to ensure it’s a viable investment. After completing the research, the investment stage takes place, where capital is deployed to acquire the company.

Once the investment is made, the focus shifts to operational improvements, where you work with the portfolio company to drive growth, optimize processes, and increase profitability. Finally, the cycle concludes with an exit, where the company is sold, either through a merger, IPO, or to another investor, to realize the returns on investment. Each stage plays a crucial role in maximizing value and ensuring a profitable outcome.

Types of Roles in Private Equity Firms

Investment professionals play essential roles at every stage of the investment process. These types of firms offer a range of roles, each with specific responsibilities. These roles can be divided into several categories:

Investment Professionals

Analysts are typically entry-level positions focused on financial modeling, data analysis, and supporting senior team members. They provide the groundwork for decision-making by analyzing investment opportunities and maintaining financial models.

Associates take on more responsibility than analysts. They manage larger parts of the deal process and start building relationships with portfolio companies. Their tasks include overseeing financial due diligence and helping execute deals.

Read: Analyst vs. Associate: Role, Responsibilities, & Salary

Vice Presidents (VPs) are mid-level managers who lead deal execution and play a role in shaping the firm’s strategy. They manage teams, oversee investments, and ensure that deals align with the firm’s goals.

Principals are responsible for sourcing and leading deals, managing client relations, and working closely with senior partners. They are integral in the negotiation process and guide the overall investment strategy.

Partners and Managing Directors hold the most senior roles. They oversee the firm’s strategy, make key investment decisions, and lead fundraising efforts. These leaders guide the firm's direction and ensure long-term profitability. Each of these roles builds on the last, with professionals at all levels contributing to the success of the firm’s investments.

Note: Professionals in these roles focus on managing and improving portfolio companies. They work closely with leadership to enhance operations, drive profitability, and help with strategy.

Investor Relations & Fundraising

These roles are critical for maintaining relationships with limited partners (LPs) and raising funds for new investment projects. Investor relations professionals ensure LPs are informed about their investments and the fund's performance.

Back-office / Support Roles

Support staff in legal, compliance, and finance handle critical operational tasks, ensuring the firm adheres to legal requirements, tax regulations, and internal financial processes.

The Private Equity Career Path: From Analyst to Partner

The path to senior roles in PE is clear but competitive. Here’s a breakdown of the typical career progression:

Entry-Level Roles: Analyst & Associate

Analysts usually start by diving into financial modeling, preparing reports, and conducting research to help senior team members make informed decisions. They analyze data and build financial models to assess potential investments. As they gain more experience, they become associates. Associates take on greater responsibility, handling key parts of the deal process, like due diligence and portfolio management. They become more involved in executing deals and managing relationships with portfolio companies, gradually taking on more complex tasks as they move up in their careers.

Mid-Level Roles: Vice President (VP)

Vice Presidents (VPs) in PE are responsible for leading deals and managing teams throughout the investment process. They oversee clients' rapport, especially with limited partners (LPs) and portfolio companies. They also play a key role in shaping the firm's strategy, evaluating investment opportunities, and guiding the execution of deals, all while balancing leadership responsibilities with day-to-day management.

Senior-Level Roles: Principal & Partner/Managing Director

Principals in these firms focus on finding new deals and building relationships with clients. They identify investment opportunities and negotiate the terms. Partners and Managing Directors, on the other hand, handle fundraising, set the firm’s strategy, and oversee all investments. They make big decisions about where the firm’s money goes and manage relationships with important clients and investors.

Career Ladder Progression

This career ladder outlines the typical progression from entry-level to senior roles within the industry. Each stage represents a key milestone in terms of responsibility and influence. Below is a breakdown of the general timeline for moving through the ranks:

| Role | Years to Promotion |

|---|---|

| Analyst → Associate | 2-3 years |

| Associate → VP | 2-3 years |

| VP → Principal | 3-4 years |

| Principal → Partner | 4-5 years |

This timeline helps provide a clear roadmap of what to expect as you advance in your career.

Private Equity Salaries and Compensation Structure

Private equity offers attractive compensation packages, which typically include a base salary, bonus, and carried interest (a share of the profits from successful investments).

Base vs. Bonus vs. Carried Interest

Base Salary: The base salary depends on the role and firm size. Analysts typically start at $75,000 to $120,000, while senior associates and VPs can earn $150,000 to $500,000 or more.

Bonus: Bonuses are performance-based and can be a significant part of compensation. Senior roles often receive large bonuses based on the firm's performance.

Carried Interest: Carried interest is a share of the profits earned from investments, typically available to senior associates, VPs, and partners. This can add a significant amount to compensation, particularly for top performers.

Compensation by Firm Size

Mega-fund (e.g., Blackstone, KKR): Compensation is often higher, with analysts starting around $120,000, plus substantial bonuses and carry.

Middle-market firms: Analysts and associates earn a bit less, but compensation still includes a solid salary and performance-based bonuses.

Boutique firms: Smaller firms may offer lower base salaries but often have more flexibility and quicker advancement opportunities.

Read: How Much Do You Actually Make in Private Equity: Salary Levels and Progression

How to Get a Job in Private Equity

Getting a job here is no easy feat. It is a competitive field that requires more than just technical skills. Most people entering PE come from backgrounds in investment banking, management consulting, or corporate finance, where they have already built a strong foundation in financial modeling, valuation, and deal execution. Having an MBA or CFA can definitely give you an edge, but it’s not just about the qualifications.

Networking plays a huge role, too. Building connections with professionals in the industry, staying in touch with headhunters, and tapping into alumni networks are all key to hearing about opportunities and making yourself stand out. And don’t forget, many firms recruit outside of regular hiring cycles, so it’s important to stay proactive. Keep in touch with recruiters and try to stay on their radar throughout the year.

Read: How to Get Into Real Estate Private Equity

Typical Feeder Paths

Many professionals move from investment banking to private equity because both fields require similar skills in financial analysis, valuation, and deal execution. Investment bankers are also well-prepared for these roles, where these skills are crucial in evaluating and executing deals.

Consultants also often transition into private equity due to their strong analytical skills and ability to evaluate company performance. MBA graduates, especially those specializing in finance or investment, also commonly enter after completing their programs at top business schools which brings advanced knowledge in financial modeling and business strategy.

Recruiting Process

Recruiting for top roles often involves working with headhunters, who specialize in finding candidates with the right skills and experience. The process typically includes technical interviews, where you'll be tested on your financial knowledge and modeling skills, as well as case studies, where you’ll analyze real-world investment opportunities. Personal interviews are also common, where you'll be assessed on your fit with the firm’s culture and your ability to work under pressure.

Off-cycle recruiting is another important aspect. This means that many firms recruit candidates outside of the usual hiring periods, so it’s essential to network regularly and stay in touch with recruiters throughout the year. By doing so, you’ll increase your chances of learning about opportunities as they come up, even when they’re not part of the main recruiting cycle.

Read: What to Know About Private Equity Recruiters & Headhunters

How an MBA or CFA Helps

While an MBA or CFA isn't always required, both can significantly boost your qualifications. An MBA helps you stand out by demonstrating advanced knowledge in business strategy, finance, and management, which is especially helpful for leadership roles. On the other hand, a CFA strengthens your technical skills in financial analysis and investment strategies, making you more competitive in the field. Both credentials show a strong commitment to mastering the key skills needed in this field and can make a big difference when applying for top roles.

Skills and Qualifications Needed for Success

To succeed, you need both technical and soft skills. Below are some skills that are essential for success in the field:

Technical Skills

Excel and financial modeling are essential skills in private equity because they help you predict a company’s financial future and assess different investment scenarios. With Excel, you build models to estimate potential returns and understand the risks involved. A solid grasp of valuation is also important because it helps you determine a company’s worth based on factors like its financial health, market position, and growth potential. Another key skill is deal structuring, where you figure out the best way to organize the terms of the investment, such as ownership percentages and financing. These skills are important because they allow you to make smart and informed decisions about which investments are worth pursuing.

Soft Skills

As you move up, leadership becomes a more important skill. You'll need to manage teams, make strategic decisions, and guide the direction of investments. It is about taking charge and ensuring everything runs smoothly. Another crucial skill is negotiation. Since private equity often involves complex deals, you'll need to negotiate terms with various parties, including clients and other investors. Being able to navigate these discussions effectively is important to securing favorable outcomes and maintaining strong relationships.

Emerging Skills

As technology advances, data analytics is becoming a bigger part of private equity. Professionals who are good at analyzing data and using automation tools will be in high demand because these skills help firms make smarter investment decisions. Another area gaining traction is ESG (Environmental, Social, and Governance) investing. More firms are focusing on sustainability and ethical factors when choosing where to invest. If you have knowledge of ESG and impact investing, it can really set you apart, making you an asset to firms looking to make socially responsible investments.

Is Private Equity the Right Career for You?

Although it offers high pay, influence, and variety, it also comes with long hours, stress, and high competition. Below is a table about the pros and cons of private equity.

Pros and Cons of a Career in Private Equity

| Pros | Cons |

|---|---|

| High Compensation: Private equity roles are among the highest-paying in the financial sector. | Long Hours: Private equity is known for its demanding work schedule, with frequent late nights and travel. |

| Influence and Prestige: PE professionals have a direct impact on the companies they invest in and a strong presence in the business world. | Stressful: The pressure to deliver results, manage investments, and maintain client relationships can be overwhelming. |

| Variety: The work is varied, with exposure to different industries, companies, and markets. | Highly Competitive: Breaking into private equity is challenging. Many roles require experience in investment banking or management consulting. |

Note: Private equity offers great rewards but also comes with its challenges, so it is important to weigh both the benefits and drawbacks before deciding if it is the right fit for you.

Who Thrives in Private Equity?

Private equity is a great fit for people who are strong analytical thinkers and enjoy solving problems. If you're adaptable, resilient, and can handle pressure, you'll likely do well in this fast-paced, high-stakes field.

Alternatives to Private Equity

If private equity isn’t the right fit for you, you might want to explore careers in hedge funds, venture capital, or corporate development. These fields offer similar challenges but focus on different aspects of investing and business growth.

Ready to Embark on Your Private Equity Career?

Private equity offers one of the most rewarding and exciting careers in finance, but it requires hard work, skill, and determination. If you're ready to take the first step toward a successful private equity career, our team of experts can help you navigate the complexities of the industry. Reach out to our Private Equity Coaches at Leland for personalized guidance and support.

The Bottom Line

Private equity offers a unique and rewarding career path, with high pay, influence, and the opportunity to work across different industries, including managing private equity fund investments. However, it also requires long hours, high stress, and intense competition. It is crucial to carefully weigh the pros and cons to determine if this field aligns with your career goals and lifestyle. If you’re ready to dive into PE, be prepared for hard work and continuous learning, but know that the rewards can be substantial.

Work with Private Equity Coaches

If you are unsure or want guidance along the way, our Private Equity Coaches are here to help you navigate the path ahead. Work one-on-one with them to build the skills and confidence you need.

Explore these helpful resources to enhance your preparation further:

- 5 Things to Know Before Entering Private Equity

- The 5 Most Prestigious Private Equity Firms

- Private Equity Interviews: The Ultimate Guide (2025)

- What to Ask Your Private Equity Interviewer

- Top Private Equity Internship Programs in 2025 (and How to Stand Out)

FAQs

Does PE pay more than IB?

- Generally, private equity offers higher compensation than investment banking, especially with carried interest, bonuses, and long-term growth potential.

What are the starting roles in private equity?

- Starting roles include private equity analyst and associate, where you will focus on financial modeling, deal sourcing, and supporting senior team members.

What is the role of a private equity company?

- Private equity firms invest in and improve companies, then sell them for a profit. They focus on managing and growing companies to maximize value.

How hard is it to get a private equity job?

- It is highly competitive, with most candidates coming from investment banking, management consulting, or top MBA programs.

Do you need an MBA or CFA for private equity?

- An MBA or CFA is not required but can enhance your qualifications and increase your chances of landing a role in private equity.

What’s the best way to start a career in private equity?

- Start by gaining experience in investment banking, consulting, or a related field. Networking and securing internships at private equity firms are key.

Is private equity a good long-term career?

- Yes, if you’re willing to handle the challenges and work demands, private equity offers long-term financial rewards, prestige, and career advancement.